portland oregon sales tax 2019

This great American city has plenty to offer visitors. Souvenir shopping can take on new life because there is no sales tax in Portland.

S3 Ep 4 I D Live In Portland Maybe Le Wild Explorer In 2020 Portland Travel Guide Portland Travel Visit Portland

A Principal Broker in Oregon Managing Broker in Washington he has been licensed since 2003 for residential real estate sales.

. Oregon law doesnt allow you to reduce your Oregon taxes because you paid sales taxes in another state. Certain business activities are exempt from paying business taxes in Portland andor Multnomah County. 425 max to sell a home in Salem and Bend.

Rates range from 5 up to 99. Portland Tourism Improvement District Sp. Weve done the legwork so that you can make the most of your time in this City of Roses.

In May 2019 Oregon imposed a new 057 tax on Oregon gross receipts above 1 million that is set to go into effect for 2020. Join speakers Nikki Dobay Senior Tax Counsel at Counsel On State Taxation COST Dan Eller Shareholder at Schwabe Williamson Wyatt and Valerie Sasaki Partner at Samuels Yoelin. Learn about Exemptions Certain business activities are exempt from.

By Pete Danko. Oregon has no state sales tax and allows local governments to collect a local option sales tax of up to NAThere are a total of 55 local tax jurisdictions across the state collecting an average local tax of NA. Staff Reporter Portland Business Journal.

A true original Portland Oregon owns its quirkiness and flaunts its artisan flair. Exciting food world-class gardens and loads of fascinating public art and galleries. The company is now collecting sales tax for online sales in at least 11 other states.

This is the total of state county and city sales tax rates. For the tax years beginning on or after January 1 2016 January 1 2017 January 1 2018 and January 1 2019 this tax is 28 percent of the total Oregon Weight-Mile Tax calculated for all periods within the tax year. October 23 2019.

Here is a quick look at a few Portland highlights. On November 6 2018 voters in Portland Oregon approved Measure 26-201 the Measure which imposes a 1 gross receipts tax on large retailers doing business in Portland with exceptions for certain industries and certain types of sales. 2019 the Clean Energy Surcharge CES is.

The state sales tax rate in Oregon is 0000. Tax rates last updated in January 2022. As a ballot measure Measure 26-201 was approved directly by Portland voters and did not go through the legislative process involving.

The entire state of Oregon including Portland has no sales taxes. See Income taxes paid to another state in Publication OR-17 for details about the credit. Compared to fellow Northwestern city Seattle with its 101 sales tax Portland looks like a bargain.

Information about Portland Business License Tax Multnomah County Business Income Tax and Metro Supportive Housing Services SHS Business Income Tax including requirements for registration filing business tax returns and paying business taxes with the City of Portlands Revenue Division. Sales tax region name. 4 max to sell a home in Portland and SW Washington.

Take an afternoon to visit Powells City of Books just. The Portland sales tax rate is. Oregon doesnt allow a deduction for sales tax paid.

The Clean Energy Surcharge CES and the Corporate Activity Tax CAT respectively. The tax is expected to raise 14 billion per year. These tax increases could hit trucking and logistics firms especially hard creating new challenges for companies that operate in.

If you made the election on your federal Schedule A to deduct sales tax paid instead of. Click here for a larger sales tax map or here for a sales tax table. File a Combined Tax Return Go to the tax forms in the Business Taxes forms library.

Sales Tax Tuesday Columbia River The Three Sisters OR Lewis Clark Oregon Department of Revenue Mount Hood OR AvaTax Crater Lake Lodge Portland OR Oregon Sales Tax Tuesday 2019 Ox Restauran - Portland OR Crater. There are no local taxes beyond the state rate. Oregon Alaska Delaware Montana and New Hampshire are the only states with no general sales tax.

The minimum combined 2022 sales tax rate for Portland Oregon is. Iowa by 1750 the remaining portion of the tax on which her 2019 credit is based. Oregon state cannabis tax revenue kept growing in the 2019 fiscal year which ended on June 30 topping 102 million a.

Oregonians have voted no nine times since the 1930s on instituting a sales tax. City of Portland Revenue Bureau. The Oregon sales tax rate is currently.

There are six additional tax districts that apply to some areas geographically within Portland. Call his team in Oregon at 503-714-1111 or in Washington at 360-345-3833. In 2018 and 2019 the City of Portland Oregon and Oregon State passed tax laws imposing new or modified gross receipts taxes on businesses.

Supreme Court ruled a state may collect sales tax from taxpayers located outside the state if they are selling to state residents and there is a sufficient connection. Cost of Living in Portland. The cities and counties in Oregon do not impose any sales tax either.

Combined with the state sales tax the highest sales tax rate in Oregon is NA in the cities of Portland. In 2019 and 2020 Portland and Oregon will impose new gross receipts taxes. On the other hand the income taxes in Oregon are quite high.

Inventory at the Made in Oregon warehouse in Portland Oregon July 24 2019. The County sales tax rate is. The Wayfair decision and online sales tax On June 21 2018 the US.

Oregon is one of 5 states that does not impose any sales tax on purchases made in the state the others being Alaska Delaware Montana and New Hampshire. All businesses must register Registration form or register online If you qualify for one or more of the exemptions you must file a request for exemption each year and provide supporting tax pages. Over 2000 homes sold.

Plan to visit Portland Oregon September 1821 at the ARCS 2019 All Members Conference AMC and experience the history the food and the shopping. General Business Forms Payment coupons exemption extension requests update account info out of business notifications temporary licenses and requesting financial information.

States With Highest And Lowest Sales Tax Rates

Oregon Economic And Revenue Forecast December 2019 Oregon Office Of Economic Analysis Economic Analysis Oregon Forecast

Since 2010 Portland Or Has Grown By 8 Here Are Five Reasons Why So Many People Are Relocating There Moving To Portland Outdoor Recreation North American

Should You Be Charging Sales Tax On Your Online Store Shirts Print Clothes Mens Shirts

Oregon S Capital Gains Tax Is Too High Oregonlive Com

Oregon State 2022 Taxes Forbes Advisor

Pin By Katie Sharon On Pacific Northwest Trip Rental Quotes Rv Quotes Cruise America

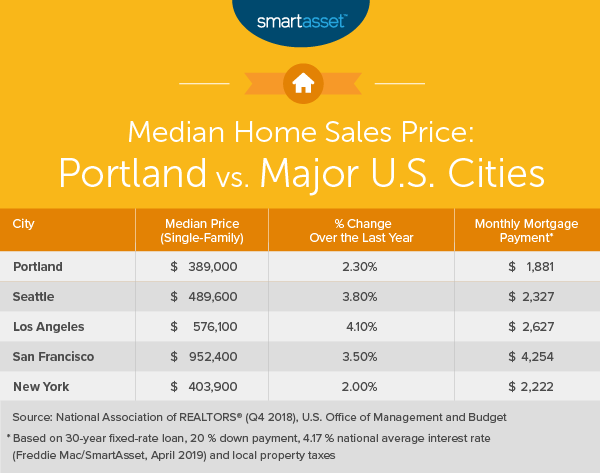

Cost Of Living In Portland Oregon Smartasset

Portland Or Travel Portland Photograph Aesthetic Roadtrip Vintage Vsco Road Trip City Aesthetic Oregon Waterfalls

2021 Portland Tax Changes Bluestone Hockley Portland Property Management

2021 Portland Tax Changes Bluestone Hockley Portland Property Management

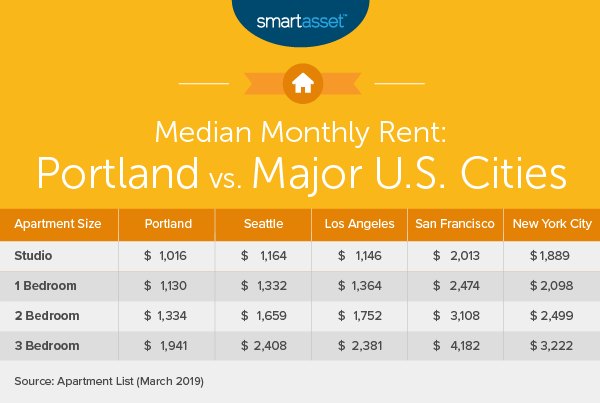

Cost Of Living In Portland Oregon Smartasset

Doug Fir Lounge Cool Kids Kids Drink Specials

2021 Portland Tax Changes Bluestone Hockley Portland Property Management

20 Honest Pros And Cons Of Living In Portland Oregon Tips

The Top 10 Reasons To Move To Portland Or Home Money

How Tax Evasion Fuels Traffic Congestion In Portland City Observatory